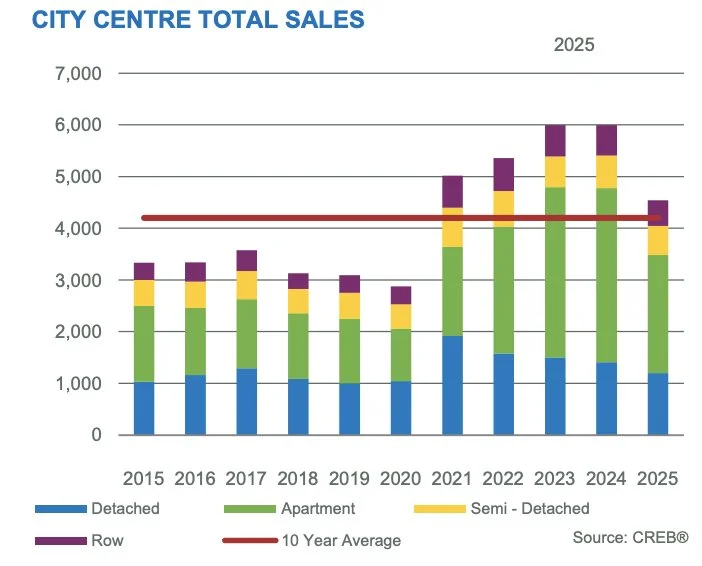

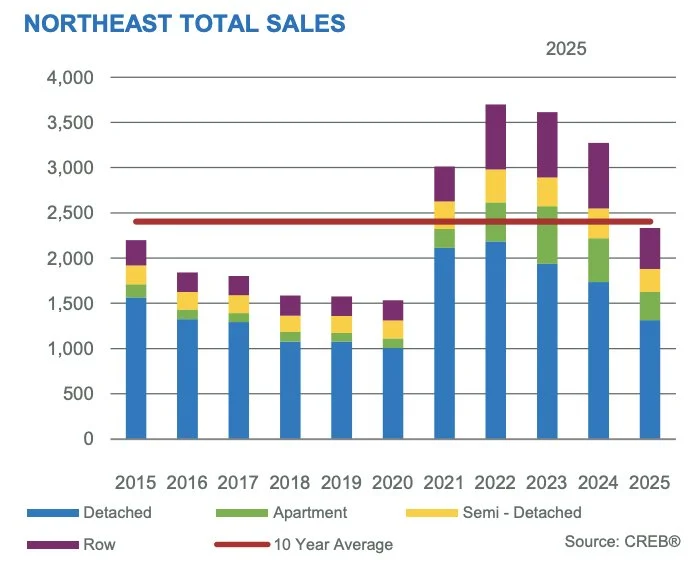

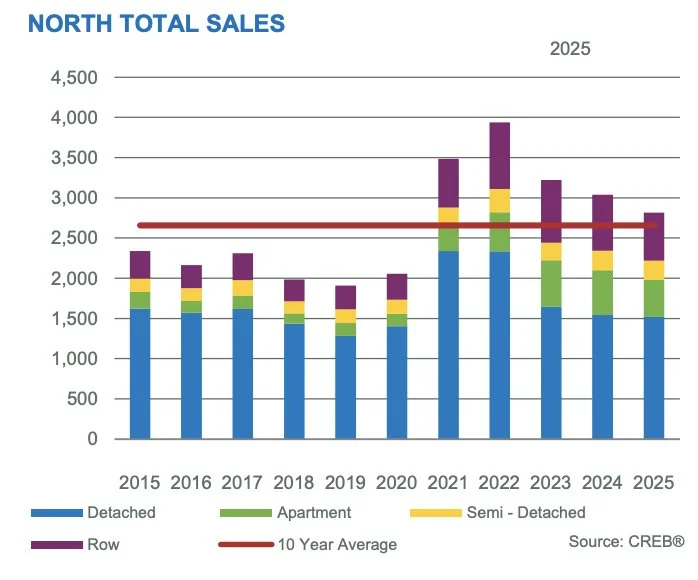

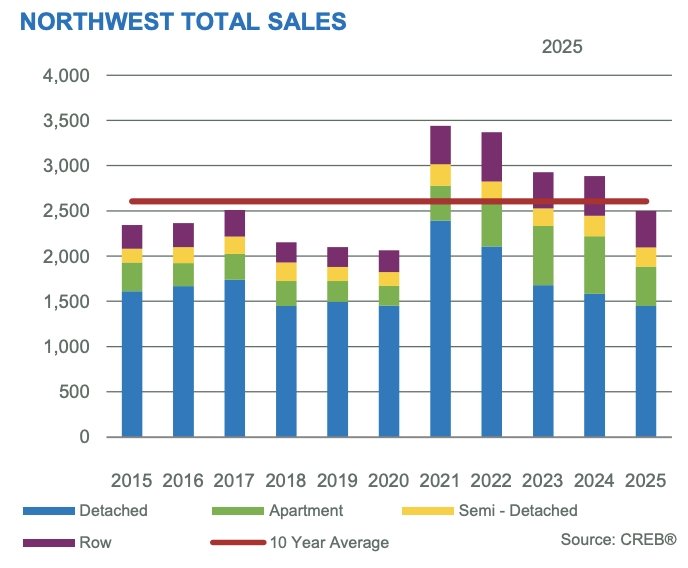

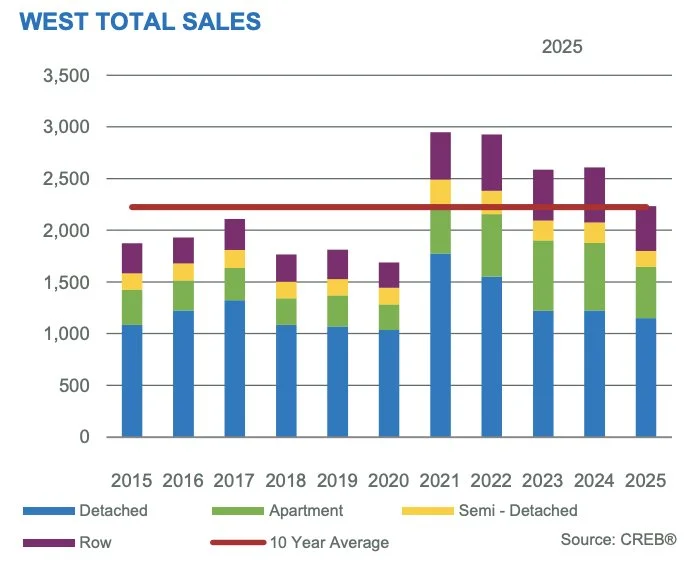

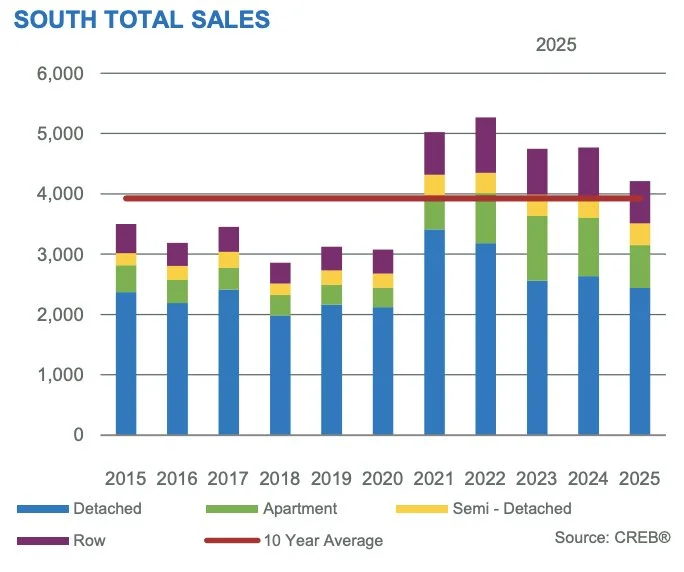

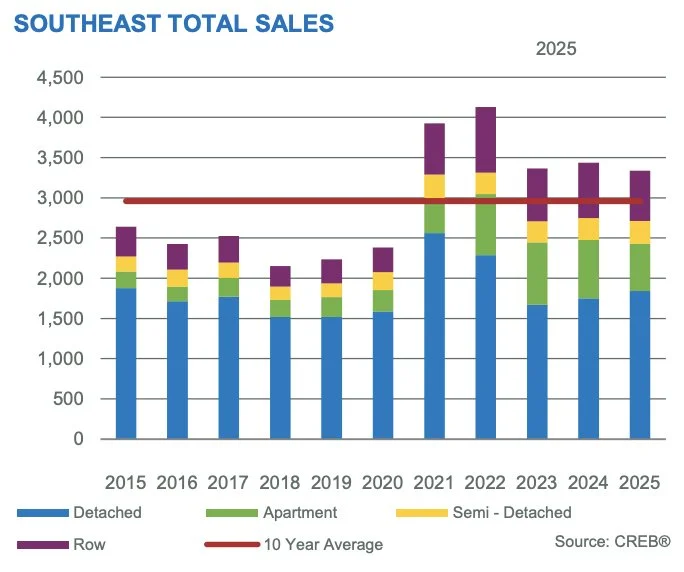

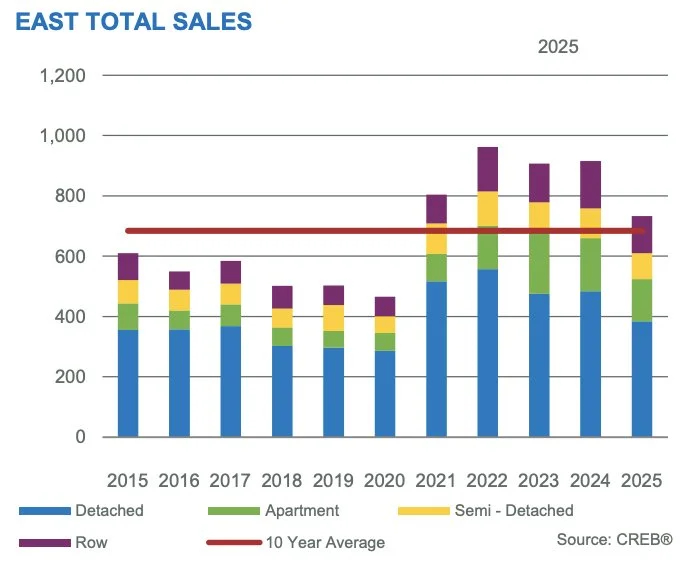

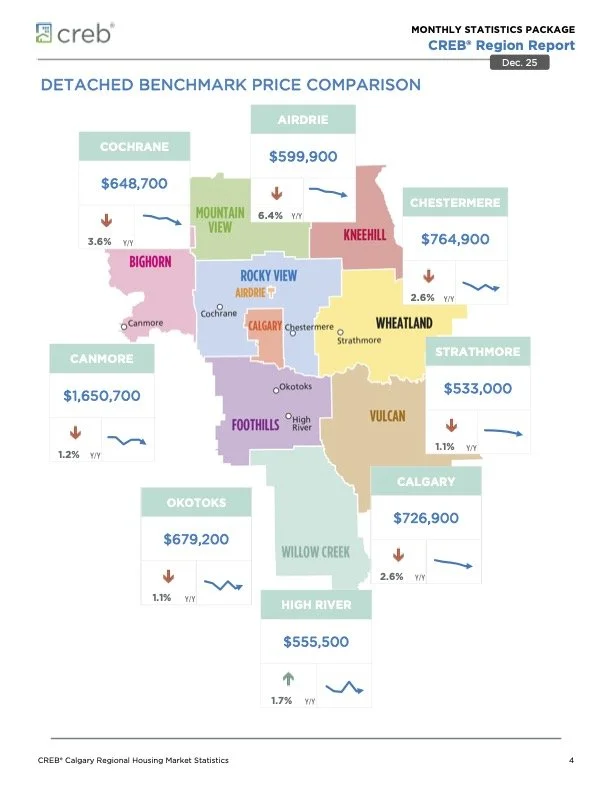

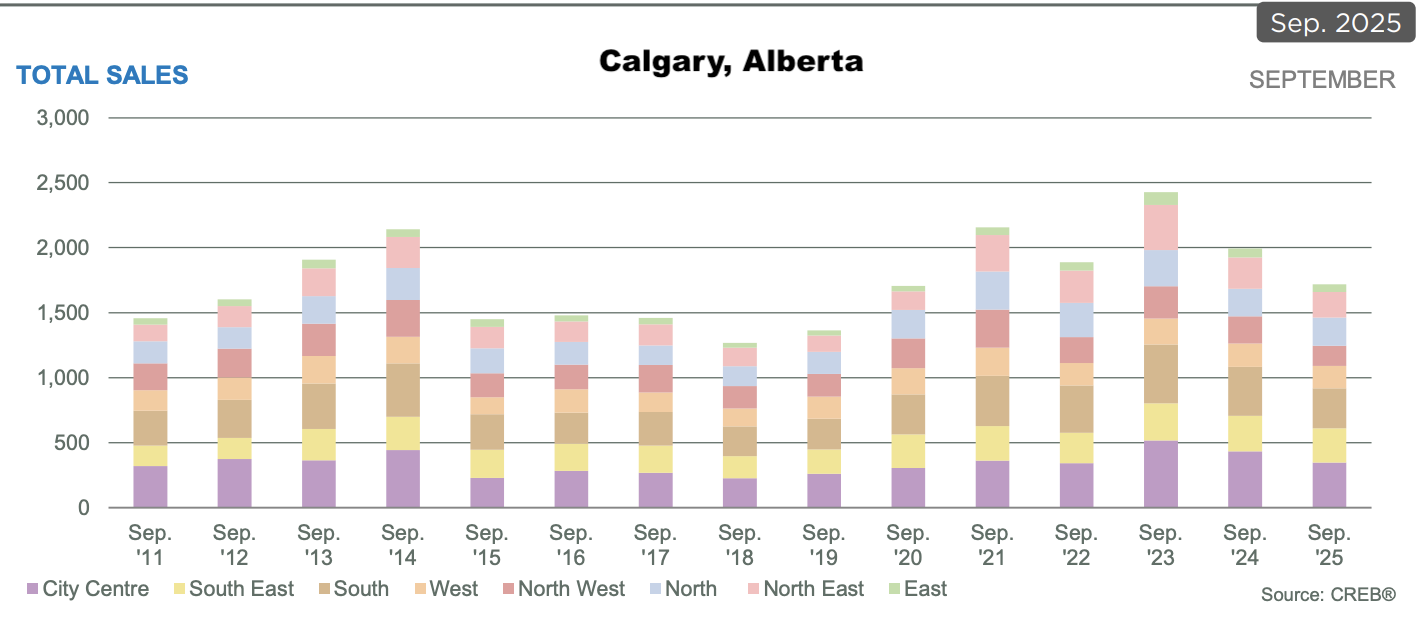

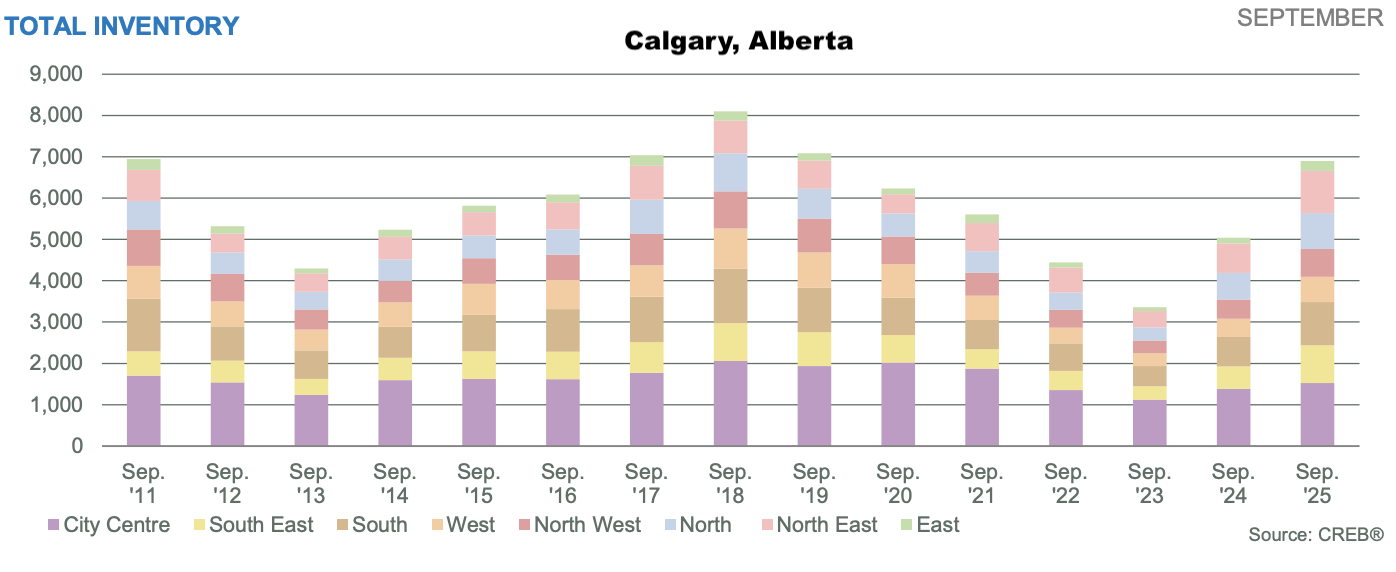

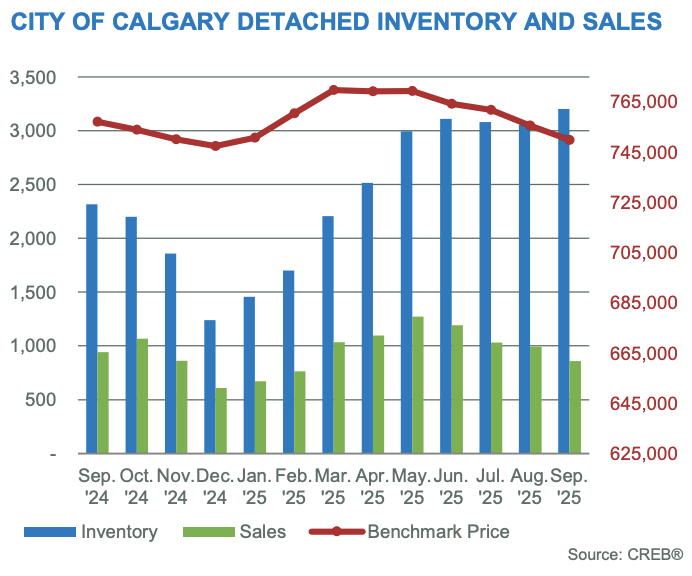

2025 marked an end to the sellers market conditions post covid. Increased new home building resulted in an increase in overall inventory combined with a reduction in immigration and interprovincial migration to Alberta. We now have what is called a more balanced real estate market. There has been some downward pressure in price in a number of regions in and surrounding Calgary with the NE quadrant of Calgary suffering the most. Overall, I expect 2026 to start off slow with bent up demand kicking in towards the second half of the year resulting in an increase in sales activity.

October 2025 sees stabilization in inventory levels

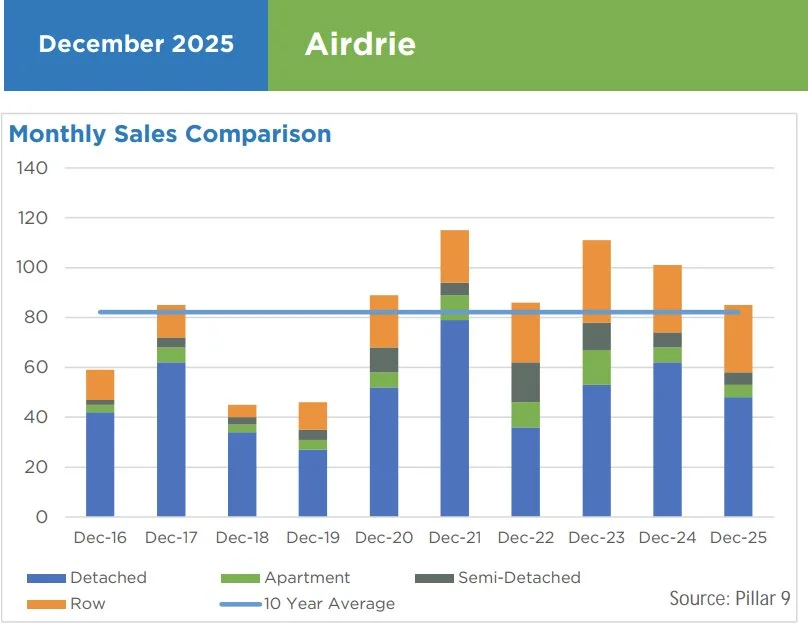

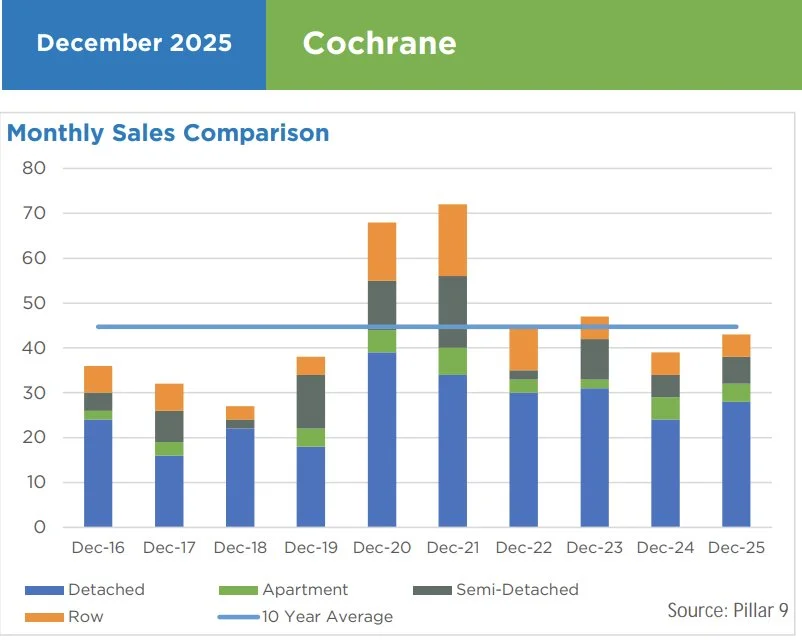

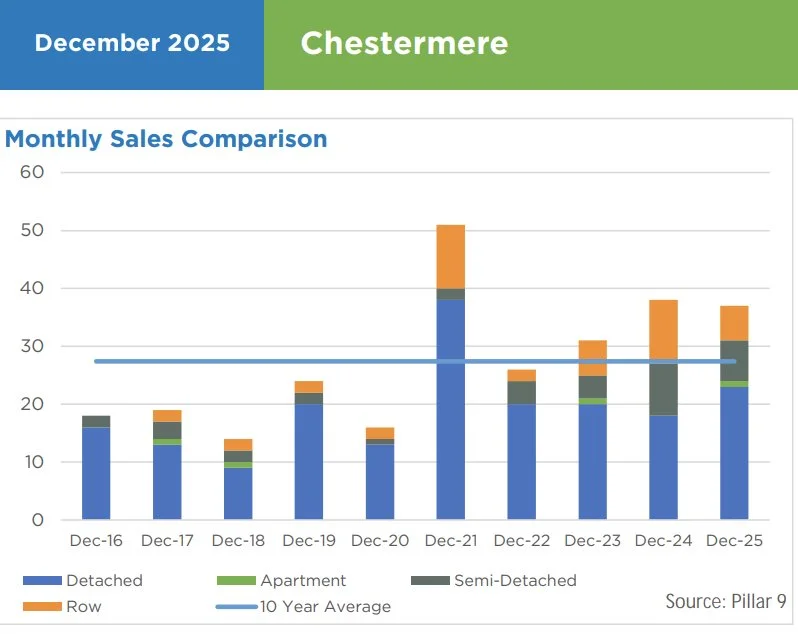

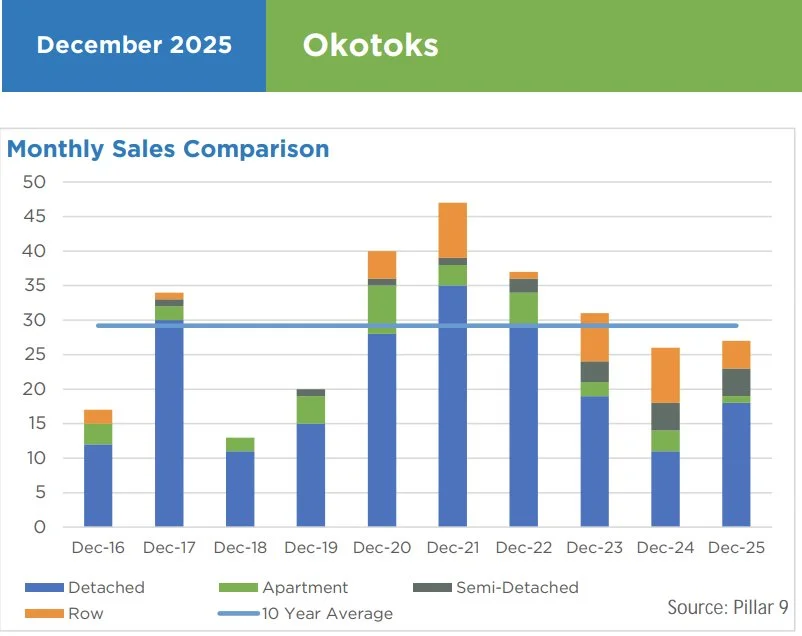

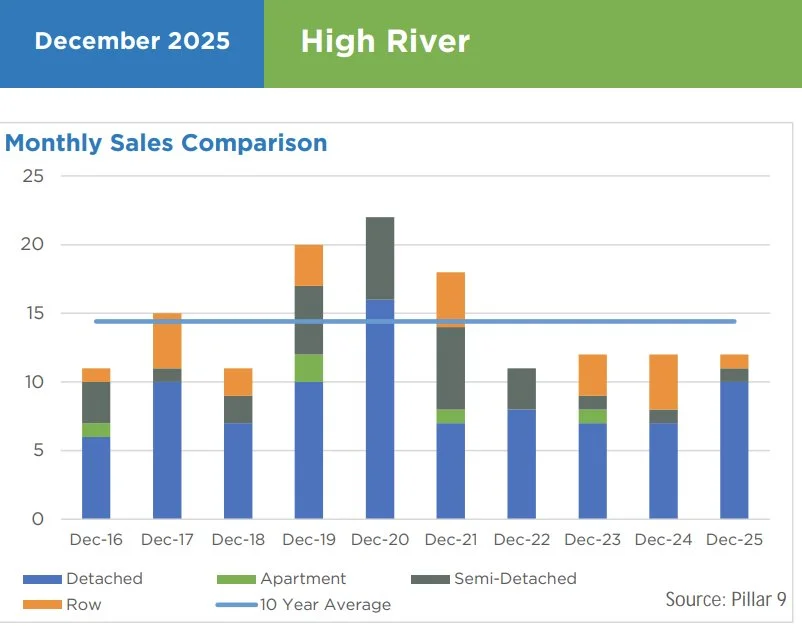

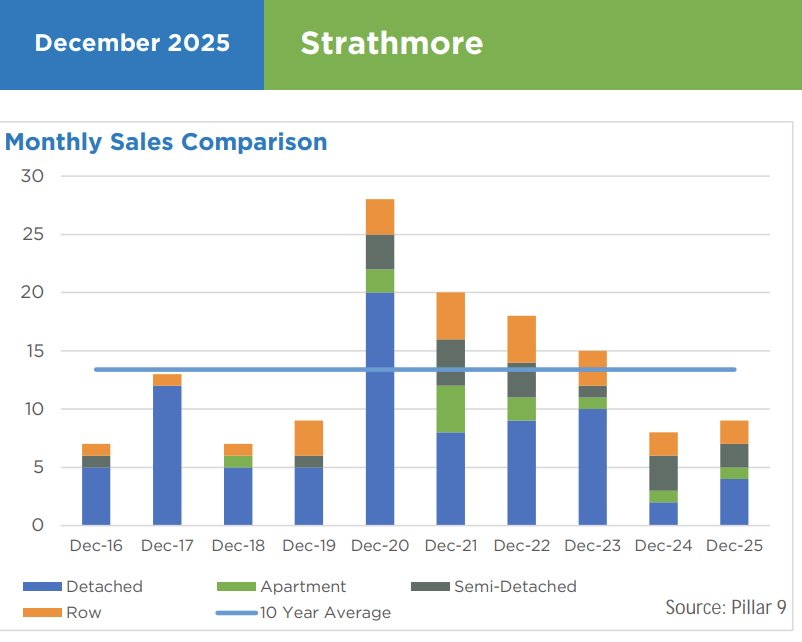

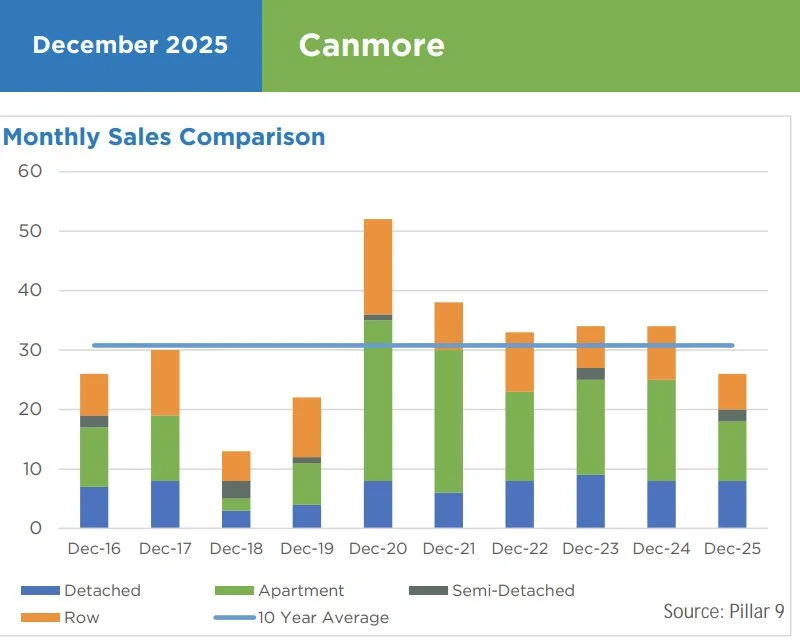

As we head into the winter months and are only 6 weeks away from Christmas, we can expect the typical slow down in real estate sales and properties being taken off the market until the spring. Inventory levels in the resale market are stabilizing. Brand new inventory continues to rise especially in the townhouse and apartment segment. Large inventories of rental accommodation have come on stream the past 6 months which has reduced the one off investor purchases ths resulting in lower overall sales volumes in the resale market. If you are looking to buy a new home or townhouse/apartment, make sure you do your research. Rural Property sales also typically slow down this time of year with not a lot of new inventory coming on until the early spring. Some good acreage buys can be had with what’s left for sale right now. The surrounding communities of Calgary are following Calgary’s market trends and usually lag behind by a few months. The price drops shown in my graphs are relative to the heady highs we had in the past couple years. Overall, market health is somewhat ok and we are not in a tailspin.

New Construction inventory rises as does resale homes. Some areas and price points move into buyer status

Lots going on in the world right now, but still lots to be thankful for this Thanksgiving weekend! A buyer of real estate right now has more choice with some deals to be had while sellers need to make sure they are astute in how, and who with, they list their home for sale. Some communities and towns outside of Calgary are doing well and will fare much better than others in the coming year ahead. Previous peaks where 2007 and 2014 for Calgary. I have started a new brokerage to meet the future challenges for buyers and sellers. A new web site is coming soon!

August 2025 real estate sales cool off which is typical for this time of year

August sales cooled off which is typical for the dog days of summer. Sales of apartments and row housing dropped the most as a flood of new inventory has entered the market. Net migration is down especially from the eastern Canada where real estate sales and pricing is in a bit of a free fall, especially in the greater Ontario region. Overall, Alberta is doing well compared to the rest of Canada as the impact of the USA tariffs are not hitting us as hard due to the American’s needing our energy. Our farming communities may be hit hard with market access this fall. We will have to wait and see what happens on that front. Of all the areas, Okotoks is doing better than almost all other regions in southern Alberta.